Yup. Bought at the end of 2019, refinanced in late 2020. Currently have a 15 year mortgage at a fixed 2.1% APR. I literally cannot afford to give this up.

It’s less that I want to leave this house, specifically, and more that I just want out of this state. For multiple reasons unrelated to my good mortgage deal, I’m stuck here for the foreseeable future.

On the bright side, I never thought I’d actually own a house so I’ll take the win.

Ditto. 2.6%. Car loan at 3.2%. Can’t afford a new car, can’t afford to move these days. Yeah, it’s hard to bitch when you’re glad to have a home, but it’s a figurative “house arrest” when market forces trap you.

Car loan at 3.2%…

I’m so envious, I’m buying a car rn and I’ll be lucky to get 9% or 10%

NFCU. Has the best auto loan rates I’ve seen or heard of anywhere right now. I’m not sure if you’re eligible, but worth looking in to.

https://www.navyfederal.org/loans-cards/auto-loans/auto-rates.html

10%?!

Holy shit.

Yeah, and that’s with a good (mid 700s) credit score.

I had a place try and reel me in at 14% the other day and I would have laughed if I wasn’t so taken aback. Like, they are closer to the maximum rate than the average…

I might just be unlucky with the dealers I have been to. Unfortunately the ones I’ve heard good things about only have cars out of my budget.

Brutal, and on top all the dealer premiums and markups.

Don’t you have to renew it every 5 years?

Nope, US has 15 and 30 year fixed rates available. You can get an arm that has a variable rate, but they’ve been un popular after 2008, and with the low interest rates not worth it.

Holy shit. We don’t have that in Canada. I wish we did. A lot of people have lost their homes due to raising interest rates as they have to renew every 5 years or so. Real estate in Canada is so fucked up.

Wow! I did not know that! You essentially refinance your home every 5 years? How does that work? With new closing costs and everything?

Not who you were talking to, but no, the closing costs are one time only. You basically just renew or get a new mortgage somewhere else. Ours is coming up in October, we’re a bit worried but hopeful it won’t be too bad. We’ve got wiggle room as we got a great deal on our house but it’s still going to suck. I have seen a 10 year fixed, might go for that if we can get a good enough rate.

What a scam. Forcing you into new higher interest rates.

In USA, refinance happens only when consumer wants to. Usually to get a better rate or cash in on some equity I think.

I haven’t heard of having to renew mortgage interest rates. A fixed interest rate should be good for the life of the loan.

I’m at 2.875% on a 25-year loan. I never plan on moving.

15 and 30 year fixed mortgages is pretty unique to the US.

That’s not a thing in the US like it is in Canada. I can keep my sub 3% mortgage for the 25 years I have left on it.

Not sure what makes you think this, but most mortgages are a contract for 15 to 30 years that lock you into a rate until the house is paid off. You may be thinking of some kind of variable rate mortgage but I though those renewed the rates way more often than 5 years but I’m not sure. It’ll all depend on the mortgage terms.

The U.S. is the only country in the world where the 30-year fixed rate mortgage is the most popular way that people buy houses. It’s the deliberate result of government policy—government-sponsored enterprises Fannie Mae and Freddie Mac buy mortgages from lenders, ensuring that they continue to offer such loans at little risk to themselves.

All the non-Americans here can’t get 30 year fixed mortgages, that’s why a good part of the Lemmings here are confused

No who told you that? If your interest is fixed you don’t fuck with that

Kinda strange reading all these comments about how people dislike their house and where they live, but can’t imagine giving up their mortgage rate.

The almighty mortgage handcuffs, the true American dream.

My wife and I LOVE our house and don’t want to leave, but we definitely thought it was going to be a starter home. We straight up could not afford the mortgage payments anywhere else at today’s rates, even in a much smaller house

I couldn’t afford to buy the house I currently live in, today. The “value” of my house almost doubled in value, and interest rates are close to triple what I have now. There is no way my family is going to move out, it’s pretty stupid that an upgrade of a home, in terms of dollar value, would put me somewhere much smaller.

Oh look it’s me. 3.125%

Its less of a problem of lock in here in Australia. Our rates tend to only be fixed for the first few years. Then you go to the variable rate. We have an opposite problem, where we have what’s known as a mortgage cliff. People who signed up at affordable repayment amounts end that lock in period and have payments jump significantly. Some are forced to sell.

Being locked in seems better than being forced to sell.

Here in Germany you can decide how long you want your rates to be fixed, with the tradeoff being that longer times of fixed rates usually have slightly higher rates (in German its Zinsbindung).

I am lucky and happy that I chose to do 30 years fixed rates, after those 30 years I only have like 2k€ left anyway, so it doesnt matter what rates I get then really.

I would like to introduce you to 2008…

Yes, just America was affectednbynthe global financial crisis. Unless you mean the sub prime rates, which ISNA different thing than fixed rates. Usually those on a sub prime rate are on a higher rate not lower.

2.875 here, my monthly payment is $545. I want to move, but it would be financially stupid to do so

Basically, unless the sale gets you enough to buy the next house in cash, it’s a bad idea, lol.

I recently gave up my 3% mortgage from 2013 in exchange for a 7% mortgage. It hurts, but it was worth it to get out of Florida.

In the end, my housing costs actually didn’t change that much because my home insurance rates were skyrocketing.

but it was worth it to get out of Florida.

You could put almost any horrific thing in front of that phrase and it sound valid.

I had to keep my arm in a tub of fire ants for 5 minutes, but it was worth it to get out of Florida.

I had to cut off several limbs leading to a bad case of sepsis…

I had to sell a few children (not mine) along the way engage in some other morally questionable activities…

I had to sacrifice my first born like Abraham did his Isaac…

…but it was worth it to get out of Florida

It reads like a country song…

🤌

I could not agree more. The flip side is likely true as well…

“I’d rather put my arm in a tub of fire ants for 5 minutes than move to Florida. “

Also home insurance isn’t tax deductible (to my knowledge unless you’re renting the house and then it counts against the income you made renting) but the interest paid is.

It’s a general problem in real estate now; commercial and residential.

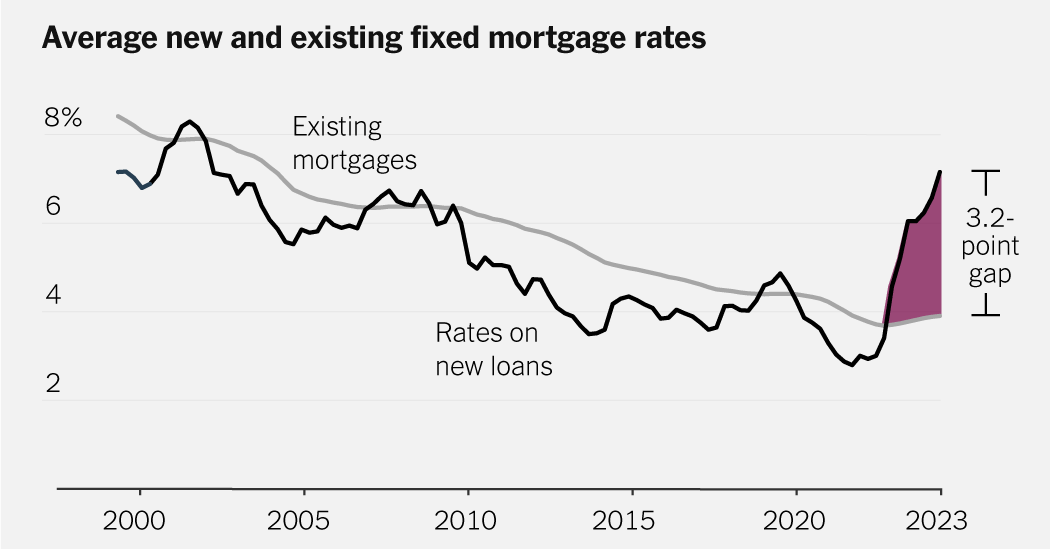

Everyone who was able to refinance to low mortgage rates locked them in. That means that just about anyone who wants to roll over a real estate investment has to take a huge hit in the process. Those rollovers are normally a big part of liquidity and they’ve all dried up.

Are we like not even allowed to talk about renting out our home in order to upgrade or something? That’s the play right now. Net present value of your almostfree money is maximized by turning it into cashflow. Plus you don’t blow 6% on closing costs, and it’s all the same to the bank in terms of getting another loan. It actually ends up being an equity asset as well as income.

Err, what I meant to say was murder all landlords.

It’s possible, if you have the savings for a second down payment. I’m pretty sure you also lose certain tax advantages if you convert your primary home to an income property. Depending on how long you’ve owned it, that can work out to a serious hit.

You can’t deduct the mortgage interest (you can on the new primary residence though), but suddenly every dollar you spend on the rental property is tax deductible as a business expense. And you can like deduct depreciation on the appliances and shit. It’s actually more tax advantaged in some situations.

The dropping interest rate is one of the main reasons that housing prices have skyrocketed in the past 20 years. People judge housing prices by what they can afford monthly and interest rates directly impact that figure. It’s only a matter of time for housing prices to fall drastically if interest rates remain at 7%.

And yes, I have a 500k loan at 2.5% on a 30yr fixed mortgage. Maybe we’ll sell our house in 15 years, but otherwise, forget it! I have zero interest in paying it off early.

Actual deflation is unlikely. You might see a kind of stagflation where prices drop relative to real inflation, but an actual widespread drop in home prices has literally occurred once in the past hundred years, and that was in 2008.

In my area prices are already down 30%. Every chart clearly shows the falling value.

Had 30 yr 3.84%, refinanced in 2021 to 15 yr 1.999%. it’s the cheapest money I’ll ever have.

Bought my house just before the crash in 2007. Felt screwed over as I went underwater and was stuck with my 6.5% loan while interest rates and home values plummeted (and because my mortgage was privately held, no HARP refi option.

Finally after nearly 15 years not only go out from under water but built enough equity for a no cost refinance. Got into a 2.25% loan.

Sad part is, despite the lower rate, due to skyrocketing insurance and taxes, my payment is no cheaper

3.25% 30 year… 27 years left.

But I’m OK staying. I’ve made huge improvements. Upgraded the electrical panel from 100A to 200A, added solar panels, added a retractible awning. Hot tub is coming.

It’s a nice house, with a good yard, will be fun to add playground stuff when we have grand-kids.

Not trying to throw shade at your shade, but I don’t think the retractable awning is building a lot of equity.

It’s a freeing feeling when you decide to put money into what you want instead of what has the biggest ROI.

I’m in year 17 of my 5 year starter home. I can’t afford to upgrade now. I’m gonna die in this house.

Hey, don’t be so glum. You could die at work for example.

I work from home lol

Nice, you’re both right.

Yeah! It’s nice when we can all agree about where that guy is gonna die.

Ok yeah you’re gonna die in your home

Same story as everyone else. Bought pre-covid, refinanced, now sitting pretty. We desperately want to move, but I would have to make like $50k more a year for the same quality of life.

Rent it out or sell it and move. How is it not a wash for whatever u want to buy?

Uhh, because of interest rates. The very thing being discussed here.

Because interest rates are way higher now?

And people moved away from cities during COVID to decrease their cost of living and get a bigger place while still being able to work from home. They bought with lover interest rates in their mortgage.

Now employers want a return to office. The employees can’t afford to move back.

Also a lot of people have discovered that no one wants to live in rural areas because they fucking suck. That’s why there’s no people there.

People don’t live in rural areas primarily because of the distance to their jobs and a lack of infrastructure. Otherwise most people would choose rural living over living in a dense city if all other factors were equal.

Closeness to nature, lack of pollution/ city noise, free use of the earth and land, etc.

Yep it’s awesome to be free of all the hassles of city life, living out in the woods basically with room to do whatever. The air is clean and fresh, and I can piss in the yard day or night.

Being close to a small town, I can even access groceries and restaurants within 10 minutes. Fiber internet is available and affordable. Wouldn’t trade it for any city.

[citation needed]

I greatly enjoy not having to drive 30 minutes to get groceries or run errands. I very much enjoy dense urban areas where everything is within walking distance or good transit.

Throw in a nice park and some greenery and I’m good. I frankly think most people would pick that than a car centric plot in the middle of nowhere.

fuck that! give me nyc. I love nature but it’s so inconvenient. it’s something to visit.

this is the problem and not people transferring 15% of the housing market into short term rentals.