Just in case anyone is curious about how it works…

Your entire income isn’t taxed at the same rate. Each chunk of your income is taxed differently. The first 11k is taxed at 10%, the next 35k is taxed at 12%, the next 50k is taxed at 22%, and it continues on at different intervals after that. This person believed that going from 44k to 45k would then change their tax bracket and their gross income would be taxed at 22%, thus reducing their net income. This is false. Only the amount over the threshold gets taxed at the higher rate. Always take a raise if it benefits you.

This person was clearly joking. Look at their username.

Still too many who don’t know this, it’s best to explain to everyone. I’ve explained it to my mother several times, and she gets it, but then conveniently forgets about that when discussing politics.

I was straight up told getting kicked into a new tax bracket would cost me money when I started working back in the 90s. By someone 3x my age. I believed it, being a wide eyed moron. I didn’t figure out progressive tax rates for like a decade after.

Just shitty one person could cost so many people so much opportunity in life.

I’ve heard of people who use this as an excuse to turn down overtime

I’ve tried to explain this to coworkers who claim to want overtime, but are afraid to due to this. They either don’t understand, don’t believe me, or don’t really want to work OT.

As long as they filled out their w-4s right they wouldn’t even have to worry. I’ve talked to too many people who put zero down and wonder why they owe every year.

I think you’ve got that backwards. My understanding is a 0 on your W2 means you’re taking no deductions and you’ll be taxed at max. Unless you’re thinking of marking as exempt, which would be no tax taken out (then you’d owe at the end of the year).

But I could be wrong there. Reading this PDF from Vanderbilt makes me think I’m not, but taxes are intentionally as confusing as possible so I’m not going to say I’m confident. I inevitably end up owing the fed and paying it with my state return, so don’t take my word for fact lol.

No w2 is the tax document, w4 is what you fill out with your employer. If you owe at the end of the year and that is your only job I would highly suggest going to your employer and updating your w4. You should be able to update your state as well. There is a tool on irs.gov called the Tax withholding estimator which can tell you exactly how much you should be taking out.

I am surprised by the amount of professionally employed homeowning parental adults I have encountered that do not know this.

It’s what happens when public education is poorly funded and doesn’t explain the basics with what little they do have.

It doesn’t help that welfare does actually work this way.

I don’t know the actual figures but my understanding is government assistance tends to work along the lines of “if you make less than $300, then the government gives you $100” so getting paid $350 is actually worse than being paid $290 for example, since going over the threshold cuts off the welfare completely.

Hell there was even a West Wing episode where they got it wrong.

That actually doesn’t surprise me because the West Wing was written by rubes.

Youd be surprised at how many think a raise gives them less

That doesn’t mean anything.

If they receive subsidized benefits like food stamps or quantity for free health benefits, they could lose those though. There’s a reason they call it the benefit cliff. My family stayed under that line intentionally for years and when decided to take raises to get out of that cycle, things were worse for a long time.

10k will get you over that hurdle in most cases unless it barely sneaks you over the benefits line. If you shoot past it though, go for it. Thresholds though, I know. Just don’t want anyone not taking a raise due to a misread comment.

As a rule though: Stay updated on the max total assets you are allowed before benefits begin decreasing, and make sure you know what is weighted.

10k is slightly less than an increase of $5/hr in pay for a full-time hourly worker. That would likely be well over of 30% pay-bump for a person working the kind of jobs that usually keep them on those programs. -At least, it would be in my state.

Let’s make it even more simple with some fake numbers to make it super easy.

$0-$10,000 - taxed at 10%

$10,000-$20,000 - taxed at 20%

$20,000-$30,000 - taxed at 30%

If you make 9 and get a raise to 11, seems like you would now pay 20% on all that! But no.

The first 10 is still taxed at 10%, only the extra $1,000 gets taxed at 20%.

If you go to 31, again, the first 10 is taxed at 10, the next 10 is taxed at 20, and only the extra $1,000 gets taxed at 30%.

$10,000-$20,000 - taxed at 20%

Goll durnit, I know 10,000-20,000=-10,000! How I supposed to pay 20% tax on -$10,000?? Do they pay ME money?? Clearly everythin you said is BULLshit!

(This is a joke just to be clear :P)

Also, considering the people who need this advice may also need to be reminded that this varies from country to country.

Where the hell are taxes this low? I pay 42% income tax, excl social insurances and charges.

USA Federal (with rounding, or a previous year).

Oh but then state on top etc.

Where are you paying 42%?

Papua New Guinea, Luxembourg and Germany are 42%, and a few other European countries have a bracket that hover around the 41-44%.

Ireland

44k to 54k, you’re right, but the post says 10k, so unless we accidentally dropped a 0 on the floor somewhere?

He’s talking about thresholds, not the actual salary. The fact that they said 44k to 45k and not 44.9k to 45k or 44.5k to 45k is just a coincidence.

For example. Say there’s a threshold at 100k and the guy was currently at 90k salary. 10k would put him at 100k and that’s no good. He would’ve accepted a 9k raise, however. He had an issue with going from 99k to 100k, not the whole raise. Or in op’s case, 44 to 45k.

Or at least that’s how I understood it.

Commenter says this person believes… And proceeds to change the numbers in the post. I feel should have been consistent with the 10k as example.

This person believed that going from 44k to 45k would then change their tax bracket and their gross income would be taxed at 22%, thus reducing their net income.

Ok, believe whatever you want /shrug

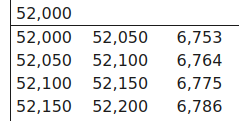

I’m not saying you’re wrong - I completely agree with you. But I have been in the position where, if I made 10 dollars less I would have paid more than 100 dollars less in tax. That just comes from the infuriating discrete tax “tables,” instead of actually calculating the tax using a continuous formula.

ETA: Apparently many here have never prepared their own tax return. Here is a sample of the tax table for 2023. The first two columns give a range of (adjusted) income, and the third is tax owed. Notice that someone who made $51,099 would pay $11 less in tax than someone who made just one dollar more. Admittedly that is less extreme that what I claimed above, but “back in the day” when I started paying taxes the tables went in much larger steps of income.

If they are right, and they are, your claim makes zero sense

I don’t think you’ve understood what my claim is. Please see my edit.

I mean, I get it, but you could also just look at it like getting an exceptionally good deal right before you hit the next table row.

Sure, but my point is that it is possible to make more money and then actually have less money because of taxes. It’s just not for the reason in OP’s post.

I’m a tax accountant.

You’ll never make less due to income tax for making more money.

You can start to get certain credits phased out and can become subject to things like the Medicare surcharge.

But it’s still unlikely that making more will ever get you less.

In a similar track though, I refused raises for a couple years because my kid was in college. If I got a raise, I would be kicked into the next income tier of financial aid eligibility, and that could’ve been catastrophic. Those lines don’t seem to phase as much as they seem to be hard cutoffs - at least as far as my kid’s specific school was concerned. All of her financial aid (grants, not loans) came directly from the school, not the government.

I also was able to enjoy a little bit of education expense credit on my tax return because if it, but that part was nominal.

The biggest hit has been going from head of household with a dependent tax credit to single with fuck all credits. Fortunately, I can itemize my way into a deduction midway between single and head of household, so I got that going for me, which is nice.

Edit: Wow, that was a gibberish filled gummy induced wall of text. Nothing particularly factually incorrect, but man what a slew of non sequitur.

deleted by creator

badmoneyguy

username checks out

This legit happened to a college of mine, at his first job (as engineer), it took me well into his second year of employment (the time when he got the second yearly income tax stats) to get him to understand what I’ve been explaining to him since he was offered a raise a few months after he started.

I tried, I really did, with charts, examples, my own income tax statement, … but no.

I never found out which part was bothering him, like theoretically, how tf …

Unfortunately he’s probably drinking raw milk these days. IYKYK.

To anyone with the math skills, I just explain it as a piecewise function. It’s pretty easy to model.

Its not a complicated function. And he is an engineer, he had plenty of maths in uni.

That’s not how that works.

"The Bottom Line

The next time you receive a raise, don’t let concerns about tax brackets dampen your enthusiasm too much. You really will take home more money in each paycheck."

Article says that is how it works

I think they were just referencing the subtitle of the article

Don’t worry—that’s not how the U.S. tax system works

Yes? Sounds like you’re agreeing with me?!

Maybe I misunderstood the person I was responding to though for sure.

deleted by creator

It’s comparatively unlikely, but there are circumstances where this type of thing can be true. Because income tax is not the only factor that matters. For example, you might get put on too high an income to qualify for some sort of tax rebate or welfare programme. Or you might start qualifying for an additional tax that isn’t applied marginally.

As one specific example, in Australia we have the Medicare Levy Surcharge, which you pay if your income is above a certain threshold and you’re above a certain age and don’t have private health insurance. If those conditions are met, it applies to all your income. It’s a small enough surcharge (ranging from 0% to 1.5%, with 1% and 1.25% steps in non-marginal brackets in between) that there are almost no practical circumstances that you’d actually end up worse off taking a raise, but it is at least theoretically possible.

Yup. It’s called the “welfare (or benefits) cliff”. It tends to happen at the lower end and the. Again at the upper middle end. There are quite a few tax breaks in the US you can’t take once you pass an AGI of $160-175K. Depending on if you were taking them, a raise could technically result in less net income.

Don’t forget at that level you’re also approaching the SSI cap (168k for 2024), which more than offsets losing those other breaks.

Yeah fucking Medicare levy.

It means I have private health and I hate the idea we are privatising our health system.

Just a side note, here I’m talking about the Medicare Levy Surcharge, which is actually an entirely separate thing from the Medicare Levy. That is a 2% levy that you can’t get rid of by having private insurance. (But can get reduced by having very low income, or can be exempt from if you’re not eligible for Medicare in the first place, e.g. if you’re not a citizen.)

Similarly in the UK going over £80k in income prevents you from claiming child benefit, and going over £100k makes you ineligible for a host of other benefits. A salary bump from 99k to 100k would be very expensive for you if had young children.

Stupidly though, a married couple each earning £99k would be able to use all benefits, but a couple where one earns £101k and the other £20k would lose out.

but a couple where one earns £101k and the other £20k would lose out

Oh damn, that sucks. In Australia most (at least) of these types of things have a separate threshold for couples where it’s based on the total income of the couple, not the higher partner’s income, preventing that kind of situation.

I believe we have it for tax allowance, where say if your partner doesn’t work, you can add their tax free allowance to yours. I think that’s it though.

You guys are getting paid?

Amateurs.

I took a 50% pay cut and my partner took a job that paid 10% less than her previous job but we moved somewhere that we got a 500k house on 1+ acre of land instead of our 800k townhouse, no land with one parking spot.

Sometimes less is more.

In Canada?

Yes, Vancouver before now I’m many hours north.

Hate getting bumped up into the 125% tax bracket

someone failed at teaching this loser mathematics.

Check his username before you eat the onion next time.

Way too many people don’t understand how marginal tax rates work.

Just went through this with my dad. He got ‘right-sized’ about a year ago and has been job hunting. He called me (praise jeebus) to ask me for advice about negotiating a slighly lower starting salary because his offer on a new job was about $140 over the line into the next bracket and he didn’t want to ‘lose’ all that extra salary to taxes.

We spent about an hour on a video chat where I ended up pulling up the IRS page about it as well as going line by line through the tax tables so I could show him how it actually works. He was flabbergasted and kept asking how could every single person he knows be wrong about this.

US public education system doesn’t teach anything related to real-world finances, including how tax brackets work.

I learned how taxes work when I was in 8th grade and then again in high school.

deleted by creator

Depending on the tax system that is an actual issue.

At least in the US there is no possible situation where you’d get less money for making more money.

Exactly, or that’s how it was explained to me. Say you get a 10k raise from 94k to 104k and the next bracket is at 100k. If your old percent was 20% and the 100k bracket is 25% only the “extra” 4k would be taxed at 25% and the 6k before that would be 20%.

Or so I’ve been told by smarter people than me. Numbers/ brackets and percentages are all made up to make it easier.

Midwest, US if it matters.

I don’t believe that’s actually true. I think in the USA there are a few programs that have a hard cap on income to disqualify you. Food and housing assistance related things. I’m not American so I’m not 100% sure on them but I do think there are some scenarios

That’s true. You’ll still be making more money, but you’ll also have more expenses. This doesn’t apply to most people though, and for sure not ones getting a $10k raise. The progressive tax system we have only applies the tax as you progress through the levels. The first $10k will be taxed at one level, then the next bracket, then the next, etc. It’s not done as one lump tax.

Different programs should be set up to slowly decrease how much you get instead of cutoff amounts. That’d remove that issue. Obviously some things are either on or off so they can’t be done this way though. Ideally a lot of it should just be provided to everyone no matter what though.

Oh yeah. That’s absolutely the case for disability I believe. If you start to make a certain amount they just take away benefits. And the amount you have to make to lose benefits it’s actually less money than what the benefits themselves are.

I know people personally who are affected by that situation.

Very good thing to point out and wasn’t something I was thinking about. Thank you.

I guess it would be more accurate to say your paycheck from your job will never be less money due to making more money.

I’m sure there are cases but that’s effectively a $4.80 / hour raise at full time, you’d need a lot of dependants or other assistance programs to make that not worth it if you’re already working full time.

Never say never. There are hard income limits for certain tax credits, like EV tax credits, and some weird COVID relief funds for dependents that actually do result in situations where you get less money for making more money. Also things like ability to fund a Roth IRA. I know because it has happened to me. Even following the tax table results in some situations where you can make a few bucks less by earning more, as someone pointed out above. Other folks have pointed out other benefits cliffs and higher education shenanigans. But you’re generally right.

Can you think of some tax systems where this is true? It’s not true in the United States at least. https://en.m.wikipedia.org/wiki/Progressivity_in_United_States_income_tax

Its not the direct tax, it’s the often counterproductive limits around welfare that many people receive alongside employment income. Welfare cliffs.

To give NZ as an example, a person can earn up to 37k and be eligible for a “community services card” which entitles them to discounts on a lot of things such as doctors fees, public transit and dental care. Earn just a dollar over thay threshold though, and you lose all the benefits, having to pay them out of pocket. Which means for someone on the cusp of eligibility, theyre often better off to turn down small pay raises.

The student allowance is similar but less punitive in that you are allowed to earn 270 per week without affecting your allowance, but after that, your allowance is reduced dollar for dollar up to the 360 per week of your allowance. A student working minimum wage would therefore need to get a 30 per hour payrise before their total income actually changed.

There are some very specific triggers to end up paying more tax than you earned - and some of those triggers are not wages (in the US). Also, those triggers are not recurring, they’re usually caused by selling capital like a home or stocks, or maxing out certain write offs, so once the extra income has been taxed you won’t see it again unless you repeat the tiggers again.

Straight up getting a raise with no other confounding factors should not cause your taxes to increase beyond your wage as the typical rule applies - you only get taxed on the wages that fall into the new tax bracket, not on all of your wages, which will still fall into their normal brackets.

deleted by creator

is joke, see name

I legit have had my boss tell me they were pissed to get a raise because taxes though. That was before I knew how it actually worked.